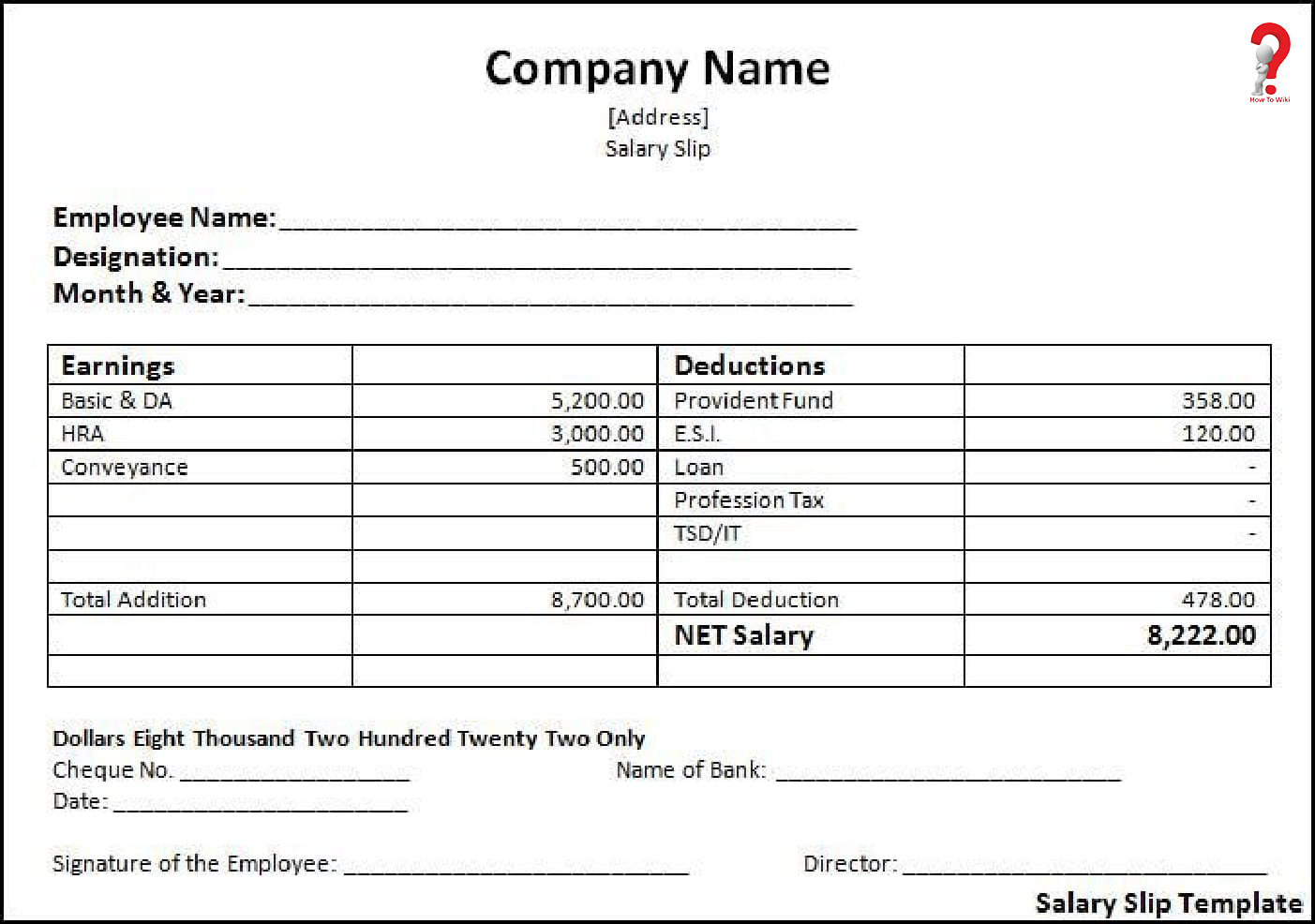

Both employer and employee equally contribute to this scheme. Moreover, it prevents the employees’ interest in certain situations like unemployment, illness, marriage, etc. Professional tax:Īn employer can deduct the professional tax from the salary. Some different types of allowances are house rent allowance, conveyance allowance, dearness allowance, medical allowance, etc. Allowances:Īllowances are the amount that the company gives for free to the employee. After deductions and commission additions, write down the payment received by the particular employee. It is the minimum payment that an employee receives each month. Write down the name of the employee, his department name, and bank account number. The important elements that should be included in every salary slip are Employee’s information

In the Income section, there are several parts to be added, such as: The elements of salary slips include Incomes and Deductions: Incomes

When it comes to applying for a new job or going out of the country, then the salary slip is the proof of the employee, that he has worked in the company.The salary slips are required to get loans from banks The salary slip helps to certify that their lending amount will be repaid by the person. With the help of the salary slip, the lender can be proven trustworthy.The salary slip allows the employee to attain free facilities such as medical care, food grains subsidy, etc.With the help of the salary slip, the tax department can identify how much refund is to be given to the employee. Salary slips help to maintain the income tax calculation. What is the Importance of the Salary Slip? Basis for Income Tax Paymentįor the income tax calculation, the salary slips are required.

0 kommentar(er)

0 kommentar(er)